Bitcoin stock price is a hot topic in the world of cryptocurrency and investing. Whether you're a seasoned investor or just getting started with Bitcoin, staying informed on the latest trends and developments in the market is crucial. To help you navigate the complexities of Bitcoin stock price, we have compiled a list of 4 articles that provide valuable insights and strategies for maximizing your investment potential.

Bitcoin has been a hot topic in the world of finance and investing in recent years. As the most popular cryptocurrency, its stock price has been subject to extreme volatility, with sharp rises and falls that have left many investors scratching their heads. Understanding the factors that influence Bitcoin stock price is crucial for anyone looking to invest in this digital currency.

One of the key factors that influence Bitcoin stock price is market demand. Like any other asset, the price of Bitcoin is determined by the forces of supply and demand. When demand for Bitcoin is high, its price tends to go up, and vice versa. Factors that can drive up demand for Bitcoin include increasing adoption by mainstream businesses and consumers, positive media coverage, and geopolitical instability.

Another important factor that influences Bitcoin stock price is regulatory developments. Governments around the world have taken varying approaches to regulating cryptocurrencies, with some embracing them and others cracking down on their use. News of new regulations or bans can have a significant impact on Bitcoin's price, as investors react to the changing legal landscape.

Technological developments also play a role in determining Bitcoin stock price. As the underlying technology behind Bitcoin, blockchain, continues to evolve and improve, it can lead to increased confidence in the cryptocurrency and drive up its price. Events such as software updates, security breaches,

Bitcoin has become a hot topic in the world of finance, with investors looking for ways to predict its stock price movements. There are several tips that can help investors make more informed decisions when it comes to trading Bitcoin.

One important tip is to pay attention to market trends and news. Events such as government regulations, technological advancements, and market sentiment can all have a significant impact on the price of Bitcoin. By staying informed about these factors, investors can better predict how the price of Bitcoin may move in the future.

Another tip is to use technical analysis to identify patterns in Bitcoin's price movements. This involves studying historical price data and using mathematical indicators to predict future price movements. While technical analysis is not foolproof, it can provide valuable insights into potential price trends.

Additionally, investors should consider diversifying their portfolios to reduce risk. By investing in a variety of assets, investors can protect themselves from losses in any one market. This can help mitigate the impact of sudden price fluctuations in Bitcoin.

In conclusion, by following these tips and staying informed about market trends, investors can make more educated decisions when it comes to predicting Bitcoin stock price movements. This article is important for investors looking to navigate the volatile world of cryptocurrency trading.

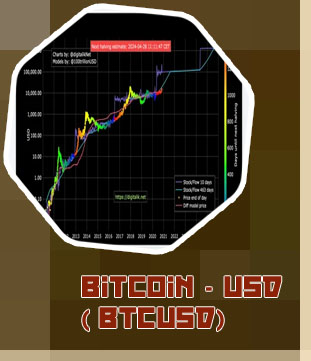

In the volatile world of cryptocurrency, predicting the future value of Bitcoin can be a challenging task. However, by analyzing historical data, investors can gain valuable insights into potential price movements. Historical data analysis involves examining past price trends, trading volumes, market sentiment, and other factors to identify patterns that may help forecast future price changes.

One key aspect of analyzing historical data is the use of technical analysis tools such as moving averages, MACD, and RSI. These indicators can help traders identify potential buy or sell signals based on past price movements. Additionally, sentiment analysis can provide valuable information about market psychology and investor sentiment, which can impact Bitcoin's price.

By studying historical data, investors can also gain a better understanding of Bitcoin's price dynamics and market behavior. This knowledge can help them make more informed investment decisions and manage their risk exposure more effectively. It is important to note that historical data analysis is just one of many tools that investors can use to forecast Bitcoin's stock price. It is essential to combine this approach with other analytical methods and market research to make more accurate predictions.

For investors and traders interested in the cryptocurrency market, understanding how to analyze historical data to forecast Bitcoin's stock price is crucial. By leveraging historical data analysis techniques, investors can potentially improve their trading strategies and make

Bitcoin stock price volatility has been a hot topic in the world of investing, with many traders looking for ways to manage the risks associated with this digital asset. As an expert in the field, I have compiled a list of strategies that can help investors navigate the ups and downs of Bitcoin's price movements.

Diversification: One of the most effective ways to manage risk in Bitcoin stock price volatility is to diversify your portfolio. By spreading your investments across different assets, you can reduce the impact of any one asset's price fluctuations on your overall portfolio.

Use of Stop-Loss Orders: Stop-loss orders are a valuable tool for managing risk in volatile markets. By setting a predetermined price at which you will sell your Bitcoin holdings, you can protect yourself from large losses if the price suddenly drops.

Stay Informed: Keeping up to date with the latest news and developments in the world of Bitcoin can help you make informed decisions about your investments. By staying informed about market trends, regulatory changes, and other factors that can impact Bitcoin's price, you can better anticipate and manage risks.

Dollar-Cost Averaging: Dollar-cost averaging involves investing a fixed amount of money in Bitcoin at regular intervals, regardless of the price. This strategy can help reduce